Slitting Machine For Warp Knitting Slitting Machine For Warp Knitting,Vertical Slitting Machine,Plush Cutting Machine,Blanket Cutting Machine suzhou cotex international Co.,Ltd , https://www.cotexmill.com Similar to the excavators two years ago, investment in concrete machinery dropped several blockbusters in late 2010 and the first half of 2011. For simple calculations, the scale of new investment has reached more than 10 billion yuan.

Similar to the excavators two years ago, investment in concrete machinery dropped several blockbusters in late 2010 and the first half of 2011. For simple calculations, the scale of new investment has reached more than 10 billion yuan.

On September 29, 2010, Liugong Group held a controlling stake in Shanghai Hongdeli and fully entered the concrete machinery business. Its sales target in 2012 was 2 billion. In 2015, it strived to achieve a sales revenue of 8 billion yuan, and entered the top 3 in the industry.

In 2010, Shantui, Nippon Nikkan Co., Ltd. and Wuhan Zhongnan Company jointly invested 1.5 billion yuan to build Shantui Wuhan Industrial Park; on April 18, 2011, Shantui Concrete Machinery Wuhan Industrial Park Phase I project was developed in Donghu High-tech Development Zone in Wuhan. District completed, the first "mountain push Chutian" brand pump off the assembly line.

On May 6, 2011, the foundation laying ceremony for the concrete mixing machinery industry base of Xugong Technology Branch was held in Xuzhou Economic and Technological Development Zone, Jiangsu. The project covers an area of ​​more than 400 acres and an investment of more than 1 billion yuan. It will form an annual production capacity of 1400 mixing machines.

On June 15, 2011, the foundation for the foundation of the Xugong Concrete Construction Machinery Industry Base, with a total investment of 2 billion yuan, covers an area of ​​675 acres. The total investment of the project is 2 billion yuan, and 3,000 units of concrete pump trucks and concrete pumps will be formed after production. The annual production capacity of 600 sets of concrete vehicles, 600 sets of on-board pumps and 150 shotcrete vehicles.

According to the investigation and study of the China Construction Machinery Business Network, many companies focused their efforts on entering concrete machinery mainly due to the following reasons:

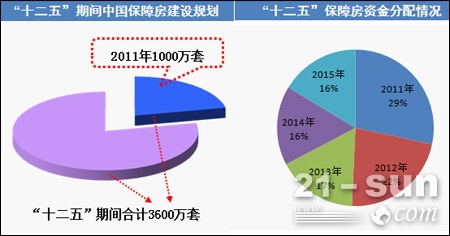

I. Broad Prospects and Large Market Capacity According to the statistics of the Construction Machinery Association, in 2010, the sales revenue of construction machinery in China was 437.5 billion, that of concrete machinery reached 90 billion, and the share of concrete machinery in the construction machinery industry exceeded 20% for the first time, and the demand went up to a new level. From the perspective of downstream demand, the contribution rate of the real estate industry to concrete machinery has reached more than 70%. In the first half of 2011, the growth rate of China’s fixed asset investment has slowed down significantly, especially since railway and highway investment have declined by more than 20% compared with the same period of last year. . Although the real estate industry is also subject to the most serious regulatory policies in history, the decisive release of the social housing protection policy has prompted the overall investment growth rate of the real estate industry to remain at historically high levels, and the construction of affordable housing throughout the entire “Twelfth Five-Year Plan†period for concrete machinery. Demand will form strong support in the next five years.

Starting in the second half of April, excavator, bulldozers, loaders and other construction machinery subdivisions all experienced a rapid decline, and absolute sales further shrank in May and June. According to the statistics of the China Construction Machinery Business Network, at this stage, only concrete machinery and paving machines have grown in a contrarian direction, and concrete machinery has benefited from the concentrated construction of affordable housing construction. The paving machine has benefited from the completion of large-scale highway subgrade construction last year. , Enter the pavement laying stage.

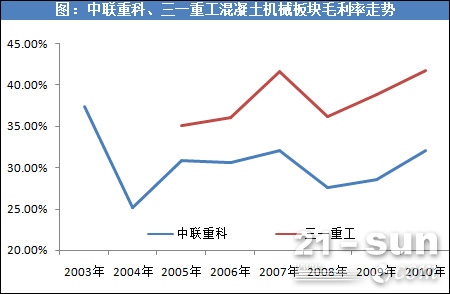

Second, high-margin profits caused by large-scale investment into the concrete machinery is a high gross profit model in the construction machinery industry, especially high-tech pumping equipment, gross profit more than other models several times. In 2010, the gross profit of Sany Concrete Machinery exceeded 40%, and Zoomlion also exceeded 30%. If the sub-machines with low profit margin such as concrete mixers are excluded, the gross profit rate of Sany's pumping equipment may exceed 50%, such a high profit rate can not be ignored by any business.

Third, to achieve the dream of large companies, 20% of the share can not ignore 20% of the share, any one of the main industries of construction machinery companies will not be ignored. In particular, companies such as Liugong, Shantui, and XCMG, which are in an advantageous position in the Chinese construction machinery industry, each have their dream of becoming bigger and stronger. A single strong machine has been unable to meet the development of leading enterprises. Product diversification is an inevitable trend in the development of the industry. In front of Chinese companies, there are successful examples of Caterpillar and Komatsu. Since 2009, China has become the largest construction machinery market in the world. In the next 10 years, its status will be unshakable. Faced with such a unique advantage, any Chinese company with an ideal will fight, and concrete machinery, like excavators, will become a leading company. Have to earn territory.

Judging from the subdivisions of concrete machinery, concrete mixer trucks are the most mature products. With low technical thresholds and sufficient competition, it is no longer the main battlefield for manufacturers to compete. The concrete mixing station (building) is gradually becoming intelligent and large-scale as a complete set of large-scale equipment. The number of production companies is also relatively high, and the gross profit rate of products is relatively stable. The main battlefield of real competition in the pumping equipment, especially the relatively high technological content of the pump truck, has become a new fat in the eyes of companies. But the reality is that these companies are not optimistic about the prospects for the development of concrete machinery. According to the survey data of China Construction Machinery Business Network, Sany in 2010 had a market share of more than 50% in the field of pump trucks and Zoomlion exceeded 30%. Judging from the product-level competition structure type, China's pump market can be defined as “absolutely exclusiveâ€, and the occupancy rate of the Sany market has exceeded the stability target value, and the distance with Zoomlion has further widened, and it is likely to become an exclusive position. In addition, as a single high-value direct sales product, customer resources have become the most important factor in competition factors, and it is no exaggeration. Chinese construction units have come along with the products of Sanyi and China United, and the supply and demand sides have formed a solid A stable cooperation relationship is difficult for other companies to infiltrate.

There is no advantage in product technology, and there is a gap in customer relations. It is impossible to cover a wide range of services. The only competitive means left for other companies is only the price. With the new investment projects gradually reaching production, the capacity will continue to expand. The car market is bound to usher in a bloody price war. Let's boldly predict the timing of the price war in the pump market. According to the investment plans announced by major manufacturers, new capacity will be gradually put into operation at the end of 2012, and production capacity will be released rapidly in 2013. It is assumed that other manufacturers in 2013 and 2014 are further technologically closer to Sany and China United, making the product quality. Can compete on the same level, then in 2015, the price war will really begin.